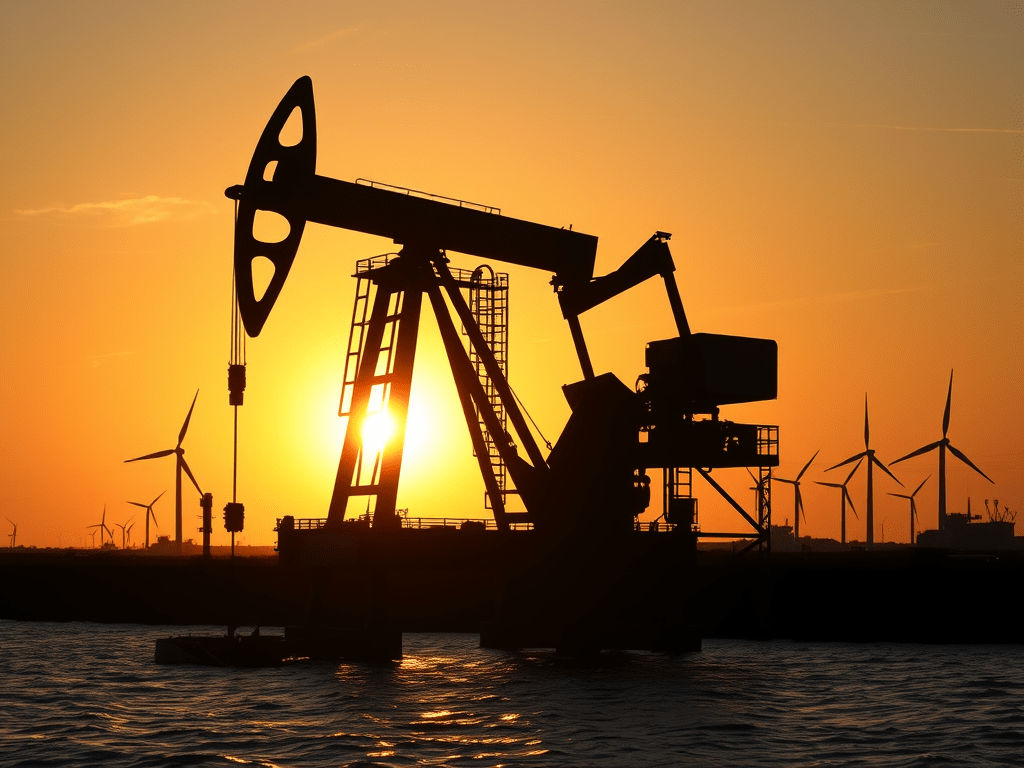

Recent industry forecasts point to a pivotal turning point: the United States — today the world’s largest oil producer — is expected to hit peak production between 2027 and 2030. After that window, growth in U.S. output may slow as reserves deplete and regulatory or permitting constraints limit new drilling. For commodity markets this is a structural signal: tighter future supply combined with stable (or slowly rising) demand is a classic setup for higher oil prices over the medium-to-long term.

Below I explain what this means in plain language, where the real opportunities and risks lie, and exactly how I help clients position for this multi-year theme — responsibly and profitably.

Why the “peak production” story matters

- Supply dynamic changes: If U.S. production flattens or declines while global demand remains resilient, the market loses a major incremental supplier.

- CapEx gap: Years of underinvestment in exploration and new large-scale projects mean supply isn’t easily or quickly replaceable.

- Tight inventories amplify price moves: When spare capacity is small, even modest demand shocks cause outsized price moves.

- Macro ripple effects: Higher oil lifts energy equities, benefits energy-exporting economies, and pressures inflation — with policy implications for rates and currencies.

In short: this is structural, not merely cyclical. It creates an investment horizon measured in years, not days.

Where the opportunities are (themes and instruments)

You don’t have to “speculate on a barrel” to benefit. Here are practical exposures that fit different objectives:

1) Energy producers (majors & high-quality independents)

Direct exposure to cash flow upside when oil prices rise — good for investors seeking dividends and capital appreciation.

2) Oilfield services & equipment

Bets on increased drilling, maintenance and capital spending as producers respond to higher prices.

3) Midstream & infrastructure (pipelines, storage, terminals)

Less price-sensitive, often fee-based cash flows that benefit from higher volumes and higher underlying commodity prices.

4) Commodities ETFs & futures-based strategies

Liquid way to express broad commodity exposure — useful for tactical allocations (note: futures carry roll/contango risks).

5) Royalty & MLP-style structures

Capital-light exposure to production revenues, often with attractive yield profiles.

6) Selective regional plays

Producers and service providers in Canada, Norway, Brazil or other resource-rich regions can benefit as global supply tightens.

7) Hedge & diversification tools

Gold/precious metals and inflation-protected bonds as partial hedges; renewables/energy transition names as long-term diversifiers.

How a disciplined investor should approach this theme

This is a strategic theme — not a call to lump-sum speculation. A clear, repeatable framework:

- Define your horizon & objectives. Is this a tactical allocation (6–12 months) or a structural theme (3–7 years)?

- Decide target exposure size. For many balanced portfolios, energy exposure of 5–10% is reasonable; more aggressive investors may scale up.

- Use staged entries (DCA). Buy in tranches across weeks/months to smooth timing risk.

- Blend instruments. Combine equities (producers, services), midstream, and a small tactical commodities sleeve — avoid over-concentration.

- Risk limits & position sizing. Cap single-position risk (e.g., 2–4% of portfolio) and set stop or review points.

- Hedge when needed. Use options or inverse instruments tactically if you want downside protection for a short horizon.

- Monitor catalysts. Watch drilling permits, inventory reports, geopolitical events, and producer capex announcements — these move prices.

- Tax & jurisdiction planning. Choose instruments with awareness of tax treatment in Central Europe, Canada, US and UK.

Example allocation templates (illustrative only)

- Conservative: 3% commodities exposure (ETF), 4% midstream/utilities, 3% majors — focus on yield and balance.

- Balanced: 6% energy equities (mix producers + services), 3% midstream, 2% commodities ETF.

- Growth/Opportunistic: 10–15% concentrated across high-conviction producers, services, and tactical futures/option plays — with strict risk controls.

Key risks you must consider

- Demand shock / recession: A global slowdown can quickly depress oil prices.

- Faster-than-expected energy transition: Rapid EV adoption or policy-driven demand decline would cap upside.

- Technological change: Breakthroughs (storage, hydrogen) could alter dynamics.

- Geopolitics: Supply disruptions can spike prices, while diplomatic resolutions can dampen them.

- Futures structure: ETFs tracking futures face contango/backwardation effects that erode returns if not managed.

Risk management is not optional — it’s the core of converting a good idea into a reliable outcome.

How I work with clients on themes like this

I’m Rachel Miller Cole — professional trader and market analyst. For clients who want exposure to structural commodity themes, I provide:

- Personalized allocation plans tailored to your jurisdiction (Central Europe, Canada, US, UK), tax situation and horizon.

- Execution discipline (staged buys/sells, limit orders, size controls) to avoid emotional mistakes.

- Tactical overlays such as short-dated options for downside protection during volatile windows.

- Ongoing monitoring & rebalancing — we treat this as a multi-year pilot, not a one-off trade.

- Transparent reporting so you understand performance, fees and risk at every step.

I do not promise guaranteed returns — I promise a professional, repeatable process that seeks to capture upside while containing downside.

Specific next steps (if you want to act)

- Reply “OIL PLAN” and I’ll send you a 1-page diagnostic: current portfolio fit, suggested target exposure and a staged-entry schedule.

- If you like the plan, we implement in tranches and I’ll provide weekly check-ins for the first 6–12 weeks.

- We’ll set automatic rebalance & risk triggers so you don’t have to react emotionally to every headline.

Final thought

A U.S. production peak between 2027–2030 is not a short-term headline — it’s a multi-year structural signal. That presents disciplined investors with a window to position ahead of broader market consensus. But opportunity without risk control is speculation. If you want a strategic, measured way to participate in this commodity story — with planning, execution and ongoing oversight — let’s work together.

Reply “OIL PLAN” and I’ll prepare your personalized entry strategy.

—

Rachel Miller Cole

Professional Trader & Market Analyst

Helping investors build resilient portfolios that capture long-term thematic opportunities. 🌍📊

Leave a comment